What is the CIS VAT Domestic reverse charge (DRC)?

HMRC announced the implementation of the Construction Industry Service VAT (DRC) domestic reverse charge from 1 October 2020. The Construction Industry Service VAT (DRC) domestic reverse charge is a new accounting procedure. This will affect builders if both the supplier (sub contractor) and customer (contractor) are VAT registered, Builders who are not VAT registered can ignore the changes. If you are VAT registered and supply services to a non VAT registered customer, you can ignore these changes too. End users are not subject to the reverse charge and VAT applies as normal.

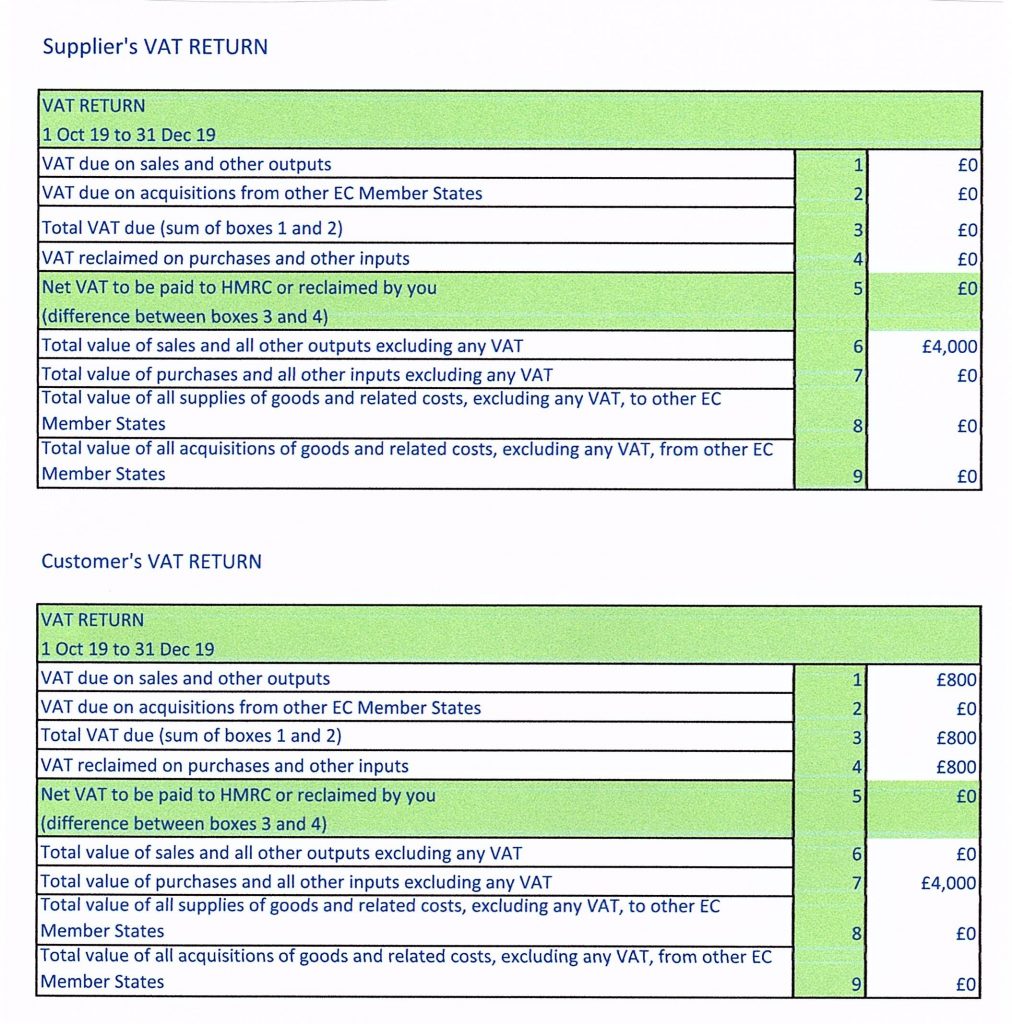

Under current rules a builder charges VAT to their customer, collects the VAT from the customer and accounts for it in Box 1 of their VAT return. This will change for supplies between VAT registered builders. The builder (sub contractor) will invoice their customer (contractor) without charging VAT and instead, the customer (contractor) makes the entry in Box 1 on their VAT return. The customer will also put the same amount of VAT in Box 4 of the same VAT return and this will have no financial impact on the customer, as the overall effect is nil. This procedure is the “Reverse Charge”.

Who will be affected by the Construction Industry Service VAT reverse charge procedures?

- Materials/goods, if they are supplied as part of the work.

- Employment businesses are excluded from the new rules.

- The legislation refers to “specified services”, but these do not apply to services supplied to non construction businesses, such as a retailer having their premises improved, or any other end user customer or building owner.

- Supplies with either 5% or 20% are subject to the reverse charge and zero rated sales are excluded.

Example

John is a Vat registered electrician and a sole trader, He is doing some work on an office block and he invoices the main contractor Colin for his work.

Colin is VAT registered and will invoice the building owner. Colin is not an “end user” as the building’s owner is the “end user”.

The invoice raised by John for labour & materials will be £4000 and subject to the new reverse charge rule and he does not have to add VAT. John’s VAT (Supplier) return will just show the sale of £4000 in Box 6 Net Sales.

Colin will do the reverse charge calculation and make the entries on his VAT (Customer) return. Please see the examples below.

- Box 1 Sales(Output)VAT £800 (ie £4000 x 20%)

- Box 4 Purchase(Input)VAT £800(same figure as Box 1)

- Box 7 Net Purchases £4000

Other issues to consider

John must ensure that Colin is registered for the Construction Industry Service and has a valid VAT registration number. John’s sales invoice must show the amount and rate of VAT that Colin must declare with the reverse charge; ie 5% or 20% VAT. John should include wording on the sales invoice along the lines of “Domestic Reverse charge applies, customer to account for VAT on their VAT return and pay to HMRC”. Colin must make sure he does not pay John the VAT. He must tell John if he is an “end user” as the Domestic Reverse charge would not apply.

The CIS reverse charge will be introduced to prevent fraud and make the contractor accountable, rather than the subcontractor. As you can see from the diagram above it will not have any financial impact.

Pingback: 2tubular